In our first article on detention, we analyzed recent industry data on detention minutes. We saw that wait times are increasing, while many carriers are accepting a higher percentage of these loads. With demand slowing, it seems this data can only mean one thing: shippers are returning to their bad detention habits.

Shippers and carriers alike should be concerned with this backslide. Even during this cooldown period, the decrease in freight demand isn’t significant enough to ease the limitations on capacity.

Although it’s unlikely we’ll see a capacity crunch like the one seen in 2017-2018, there are still times of the year where demand rises, like the spring and winter retail season. In the event there’s an upswing in demand, shippers and carriers will still find themselves struggling keep costs down to bring goods to market.

Those who don’t study history are doomed to repeat it. In this article, we’ll look at the factors that led up to the capacity crunch of 2017-2018 so shippers and carriers can avoid making the same mistakes this year.

How Did We Get Here?

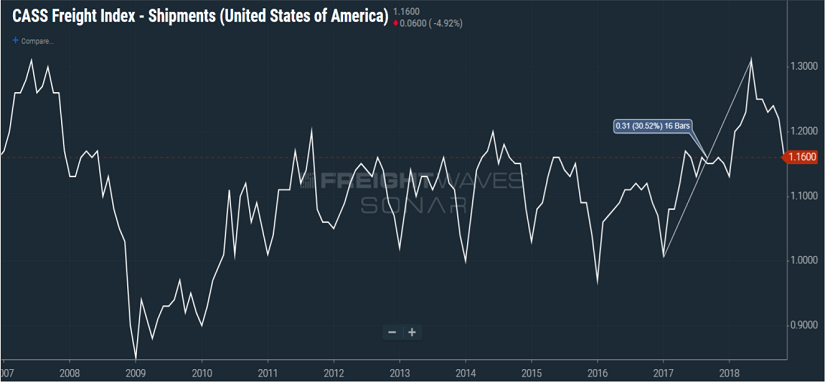

After the great recession bottomed out in the late 2000’s, a pattern emerged where freight volumes rose every year and would fall back down come January of the next calendar year. This predictability was great. Year after year, carriers and shippers could rely on the cyclical ebbs and flows to scale their operations, without needing to address the underlying, widespread inefficiencies in the industry.

Then 2017 happened. Freight demand kept rising and instead of tailing off at the expected time, the lull of January 2018 never came. Increased demand, compounded by an ever-worsening driver shortage and the ELD rule, clashed against a dwindling supply of available trucks and drivers. In June 2018 freight volumes peaked to their highest point since 2007. By that point, capacity had evaporated and carrier rates took off.

Shippers Paid the Price

In a race to move their goods, shippers turned to the spot market, which also saw a spike in rates due to the volatility of the market. As a result, many shippers burned through their routing guides in the first quarter of last year and missed their budgets.

The Cost to Carriers

Theoretically, this should have been a win-win for carriers. With more options for truck utilization, they had more leverage to reject loads based on factors like on-time payments and hassle-free pickups. In reality, carriers couldn’t take advantage of the opportunity right away. When an influx of freight moves in, carriers can’t easily scale up fast enough to manage these surges. The systems in place are designed to manage an average level of volume based on year-over-year trends— not anomalies. Carriers had to scramble to cover the costs to build out greater infrastructure to handle the surge in volume, not to mention the associated costs of ELD.

Conclusion

Higher-than-average-economic growth meant that shippers and carriers were doing business more than before. As great as that sounds, it also exposed a difficult capacity problem. The quick and easy thing to do was to throw money at the problem. However, as the market enters a cool down period, carriers are stuck holding the bill for surplus resources and find themselves facing the new challenge of cutting costs. Unless shippers and carriers can learn to work collaboratively to improve inefficiencies in the detention process, both parties will continue to pay the price.

See part 3 of this blog series in two weeks for tips on how to carriers and shippers can work together to speed up the detention process.